![]()

From Inflation to Deflation

By Paul Lamont

March 31, 2008

The panic we suggested would occur in our report last month has enveloped the credit markets.

“When the house of (credit) cards begins to fall in on itself, the trend turns from inflation to deflation. That’s when creditors turn their focus from lending to collecting and debtors turn their focus from borrowing to repaying. But by this time there are too many IOUs, and debtors cannot service them, much less repay them. Falling asset values and economic contraction thwart efforts to honor the loans. Debtors begin to default. When that happens, the game is up.” – Bob Prechter, Elliot Wave Theorist

With the default of the Carlyle Group fund, buyout/bankruptcy of Bear Stearns and forced selling of mortgages by UBS; the game of the last sixty years is up. U.S. home prices are down roughly 12% since the top registered last July, consumer confidence has fallen to the lowest level in 35 years, and banks are hoarding cash as regulators prepare for a surge in failures. Commodity markets including the precious metals have recently experienced vicious reversals. Even “cash-like” securities are losing value. With the mortgage bond market acting like the stock market of 1929, the enablers of credit are experiencing a margin call of epic proportions. As in the 1930s, the Fed is failing against market forces. Finally the financial media is reporting the severity of the crisis:

“The problem is that vital markets that most people never see - the constant borrowing and lending and trading among huge institutions - have been paralyzed by losses, fear, and uncertainty. And you can't get rid of losses, fear, and uncertainty by cutting rates.”

Bank Deposits

“Real-estate loans, not failed stockbrokers’ accounts, were the largest single element in the failure of 4,800 banks in the years from 1930 to 1933.” Homer Hoyt. One Hundred Years of Land Values in Chicago.

We are expecting a large number of bank failures as conditions deteriorate:

“At times like these, also,

it becomes clear that bank deposits are not really money- even on a paper, let

alone a gold standard- but mere money-substitutes,

which serve as money ordinarily, but reveal their true identity when nationwide

confidence begins to collapse.” Murray Rothbard, America’s Great

Depression.

While bank

deposits up to $100k are insured, the FDIC is under no time restraint to pay

depositors back. Similarly, many hedge funds have

halted withdrawals “tying up tens of billions of dollars for an

indefinite period.” Due to FDIC backlogs, we expect that bank depositors

will not have access to their cash when it is time to benefit from bargain

prices.

Looking Back To May

In last year’s article titled “May 10th – Credit Collapse,” we provided a description of the credit crunch of 1837. We return to the year 1837 once again, specifically to Chicago, where easy credit had induced a real estate bubble. Homer Hoyt in One Hundred Years of Land Values in Chicago describes the impact of the credit collapse:

“Under these conditions it soon became impossible to borrow money on real estate or to renew existing loans…Still there was no distress sales and no drastic declines in land values. In 1838 business improved temporarily and the Illinois banks, after a suspension of thirteen months, resumed specie payments on August 13, 1838. Only 17,640 acres were sold (436,992 acres in 1836) by the Chicago land office in 1838, however, and very few sales were made in Chicago itself. Another financial crisis swept through the country in the autumn of 1839…That real estate values had declined drastically could no longer be concealed by 1839. The extent of the decline was revealed when the government insisted on selling…”

William B. Ogden, a resident of Chicago, reveals the extent of the decline in a November 1839 letter preserved by the Chicago Historical Society:

“One fourth of 1836 prices can hardly be obtained for much business property at this time and one 10th to a 20th is about all town property will bring or is worth compared to sales of 1836.”

The Long View

“I believe that banking

institutions are more dangerous to our liberties than standing armies. If the

American people ever allow private banks to control the issue of their

currency, first by inflation, then by

deflation, the banks and corporations that will grow up around [the banks]

will deprive the people of all property until their children wake-up homeless

on the continent their fathers conquered. The issuing power should be taken

from the banks and restored to the people, to whom it properly belongs.”

- Thomas Jefferson, Letter to

the Secretary of the Treasury Albert Gallatin (1802)

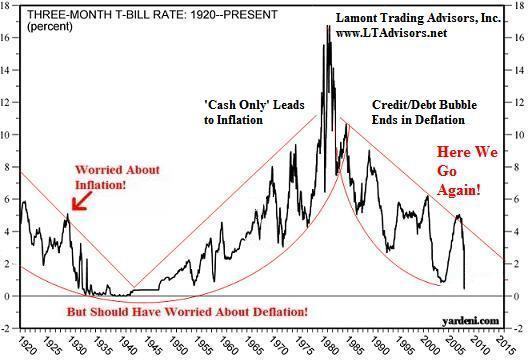

Last February, we presented a long term U.S. Treasury Bill chart to show investors the last hundred years of the credit cycle. The full inflation/deflation is shown below:

A Line In The Sand

As seen in the chart below, the Dow Jones Industrial Average has been tapping on the floor that was once the ceiling of 2000.

While we could have a short-term bounce in the DJIA, a break of this level would be significant. Citigroup’s stock price (shown below) is merely leading the broader market index.

Deleveraging Economy And A Commodity Collapse

As assets fall, investors are seeking the haven of U.S. Treasury Bills, evidenced by the plunge in the yield. But what about the fall in the U.S. dollar? There is a widespread belief in the continued fall of the dollar and the chart below shows why. For most of recent history, the U.S. Dollar has lost purchasing power. But, if you look carefully, the only significant rise of the last 100 years occurred during the deleveraging economy of 1930-1933.

The rise in the value of the U.S. Dollar during the 1929-1933 period was also reflected in the collapse of various commodity prices.

The “dollar was backed by gold” is the excuse given by most goldbugs for the dollar’s strength during this time. This argument fails to recognize that the international reserve currency of the day, the British pound was separated from its gold-backing in 1931. After quickly losing 30% in value, Great Britain subsequently fell into a deflationary depression. Coincidence or not, the U.S. Dollar has fallen roughly 30% since 2000.

Printed ‘Money’ and the Psychology of Lending

Most believe that the Fed/Treasury Department/President’s Working Group on Financial Markets will somehow print more money than the market is destroying. However, what we mostly use today as money is not printed dollars. It is credit, which is based on the confidence of bankers to lend and of borrowers to pay it back. Without confidence, ‘money’ is taken out of the system. The fractional reserve banking system makes this more pronounced. As Rick Schottenfeld, chairman of the Schottenfeld Group, describes:

“We’ve written off about $200B in our banks. And banks have about 8% capital for every dollar they loan. So another way to look at that is to say that 12.5 times that was removed from the economy. That’s $2.4 trillion dollars, which is equal to the U.S. government’s budget.”

In addition, actions by the Fed during boom times are seen as market saviors (such as the 1998 LTCM deal). But interventions during down moves are at first met with approval but ultimately viewed as making things worse. As the article states, investors are concerned that the wild-eyed Fed (on the excuse to save the system) could force financial institutions into deals like the Bear Stearns buyout. So why would investors hold financial stocks? Instead of bailing out banks, the Fed’s actions create more selling, panic, and fear. It’s all about investor perception, which the Fed cannot control.

What’s Next?

While we should expect rocket-launched (oh, they’ve saved us!) bear market rallies, eventually Wall Street Firms will run into more troubles. Investors holding securities in margin accounts at troubled firms will find that at best they will not have access to funds, at worst they will learn new words like ‘rehypothecation’ and ‘arbitrament.’ If you have a friend or relative with funds at these institutions, alert them of their precarious position.

They’re Selling, Mortimer - Why, That’s Ridiculous!

At Lamont Trading Advisors, we provide wealth preservation strategies for our clients. For more information, contact us. Our monthly Investment Analysis Report requires a subscription fee of $40 a month. Current subscribers are allowed to freely distribute this report with proper attribution.

***No graph, chart, formula or other device offered can in and of itself be used to make trading decisions.

Copyright ©2008 Lamont Trading Advisors, Inc. Paul J. Lamont is President of Lamont Trading Advisors, Inc., a registered investment advisor in the State of Alabama. Persons in states outside of Alabama should be aware that we are relying on de minimis contact rules within their respective home state. For more information about our firm visit www.LTAdvisors.net, or to receive a copy of our disclosure form ADV, please email us at advrequest@ltadvisors.net, or call (256) 850-4161.