![]()

When Assets

Fall

By Paul Lamont

Nov. 29, 2007

"Our entire banking system is a complete disaster. In my opinion, nearly every major bank would be insolvent if they marked their assets to market."- Andrew Lahde, founder of Lahde Capital (a California hedge fund), which has returned over 1000% this year shorting subprime derivatives.

According to the Markit ABX derivative indices, Andrew could be correct. The credit crunch has spread beyond ‘just subprime.’ ‘AAA’ residential mortgages created in 2007 are worth 30% less than when issued. Home mortgages that have less than an 'AA' rating from ’07 are worth at least 70% less! Remember we operate under a fractional reserve banking system. For instance, a bank’s portfolio might consist of 10% cash backing 90% mortgages. Obviously, we expect to see more banking problems in the near future.

SIVs Moved On Balance Sheet

On Monday November 26th, HSBC announced that it would transfer $45B worth of SIVs (off-balance sheet assets) onto its own books. As we discussed last April:

“Current ‘thinking’ is that financial institutions have passed on much of the mortgage risk to hedge funds. However when hedge funds fail, ‘prime brokers’ historically have been forced to accept the hedge fund’s losing positions. Illiquid arrangements (for instance credit derivatives) will then be the responsibility of the prime brokers. They will be forced to sell at any price as they try to prevent losses on their own books.”

HSBC’s action will at least provide some transparency on their SIV losses. It also signals to the market that they might be manageable. When confronted with the same proposal, Citigroup refused to do the same with its SIV assets. We can only assume that the SIV losses are too large. According to Peter Eavis at Fortune, Citigroup also had implicit obligations to CDOs that are off-balance sheet totaling $73 billion. So Citigroup has roughly $160B ($73B CDO+$90B SIV) in off-balance sheet assets of questionable value. In addition, no institution has made loss disclosures on Home Equity loans which were so popular during the mania.

How’s the SIV Bailout Fund Coming?

No one wants to fund the Master-Liquidity Enhancement Conduit (SIV bailout) proposed last month. “’Why should we put something on our balance sheet that is going to result in further write downs?’ is how most contributors will respond, Richard Bove of Punk Ziegel & Co. said in an interview.”

Junk Bond Rates

In the meantime, Citigroup is borrowing on its Middle Eastern credit card. Notice that the $7.5B in cash cost Citigroup 11%, which is a “junk bond rate.” Analysts are very skeptical that Citigroup will even have enough cash to pay its dividend. Also, the source of the ‘bailout’ was a foreign government-owned pool. Last month we mentioned: “Investors from Europe, Asia, and the Middle East are buying U.S. stocks in record amounts. As market timers, foreign purchases make excellent contrarian indicators.” While Abu Dhabi’s investment might work out, it is oddly similar to Bank of America’s $2B investment in Countrywide in August. According to Bloomberg, that investment has so far lost near 50%.

Another Run At A Fund

The halting of fund redemptions is becoming an all too familiar occurrence. The latest comes from Florida officials who manage an investment pool for schools and local governments. The fund was supposed to be in cash (U.S. Treasury Bills), instead they “invested $2 billion in structured investment vehicles and other subprime-tainted debt.” Also “about 20 percent of the pool is in asset-backed commercial paper.” We have been adamant that ”investors should especially stay clear of money market funds which include asset-backed commercial paper.” Coleman Stipanovich, executive director for the Florida pool, describes the ABCP market: “’There is no liquidity out there, there are no bids’ for those securities.” If there are no bids when forced to sell, the market is valuing the asset at zero. When investors did the correct thing and demanded their money back, managers halted redemptions. Stipanovich gave the excuse: “if we don't do something quickly, we're not going to have an investment pool.” This arrogance really angers us. Any remaining money should be immediately returned to investors. For this very reason, we are asset managers with no ‘fund’ (clients have their own accounts). We do not want to stand between investors and their money.

Selecting a Brokerage Firm

Recently, we suggested that “investors should select brokerage firms that are financially healthy, have historically few customer legal disputes, and have no investment banking department.” Weiss Ratings, now TheStreet.com Ratings, provided a useful report in 2002 with guidelines on selecting a brokerage. Differences in brokerage firms will become more apparent in a stressful environment. The same applies to banks and their varying lending standards.

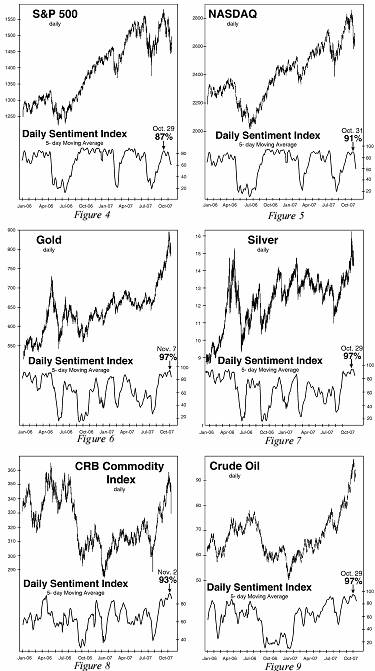

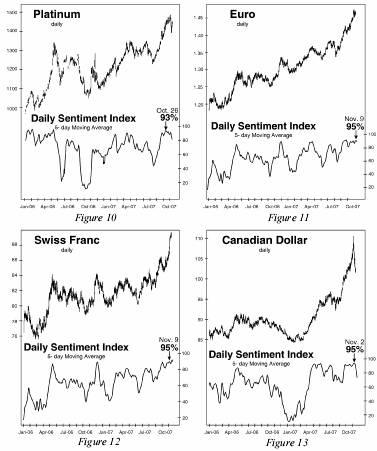

Traders Bullish On Everything

Despite the widening of the credit crunch, home prices "falling the sharpest on record," homeowners feeling the pinch and earnings coming in weaker-than-expected; Wall Street traders have maintained a bullish position towards almost every asset class. The charts below, compliments of The Elliot Wave Theorist (Elliotwave.com), show recent sentiment levels from MBH Commodities’ Daily Sentiment Index.

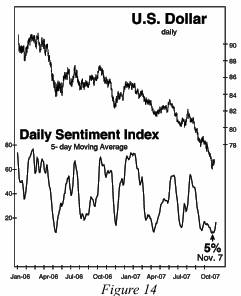

Everything, except the U.S. Dollar…

Why would investors need U.S. dollars in the future? Perhaps to settle U.S. debts. While we believe Goldman Sachs’ ‘back-story’ is incorrect (they are bullish), their technical analysis indicates a bottom in the U.S. dollar. Like us, they are also now bearish on gold and bullish on the Yen.

Even Art Prices Dropping

Art prices are also reacting to the credit bust. On November 9th, Sotheby’s had to pay out on price guarantees after they failed to sell Impressionist and Modern art. Its stock price is below.

William Ruprecht, Sotheby’s CEO, was quoted as saying: "Some of our estimates were ambitious and were informed by great successes we had earlier in the year." Dana Cohen, an analyst at Banc of America Securities, concluded “lackluster performance suggests that key fears related to subprime/credit/housing issues may be playing out in the U.S.”

As we stated last month, “it is as if you woke up one morning and paper cash was the only medium of exchange. No credit cards, loans or mortgages.” The credit boom has inflated all asset prices. As credit shrinks, assets will fall but the debts will remain. As Fredrick Lewis Allen (Since Yesterday) described the economic environment of 1932; “the amount of money paid out in salaries had dropped 40 per cent, dividends had dropped 56.6 per cent, and wages had dropped 60 per cent. Thus had the debt structure remained comparatively rigid while other elements in the economy were subjected to fierce deflation.”

After the Crash…Yeah Right!

In the 1930s, there was a general mockery made of bankers’ and economists’ bullish stock market prognostications. Since the summer, the blogosphere has been abuzz with the ex-CEO of Citigroup Chuck Prince’s quote. A couple of British comedians John Bird and John Fortune have also begun lampooning investment bankers and the subprime collapse.

At Lamont Trading Advisors, we provide wealth preservation strategies for our clients. For more information, contact us. Our monthly Investment Analysis Report requires a subscription fee of $40 a month. Current subscribers are allowed to freely distribute this report with proper attribution.

***No

graph, chart, formula or other device offered can in and of itself be used to

make trading decisions.

Copyright ©2007 Lamont Trading Advisors, Inc. Paul J. Lamont is President of Lamont Trading Advisors, Inc., a registered investment advisor in the State of Alabama. Persons in states outside of Alabama should be aware that we are relying on de minimis contact rules within their respective home state. For more information about our firm visit www.LTAdvisors.net, or to receive a copy of our disclosure form ADV, please email us at advrequest@ltadvisors.net, or call (256) 850-4161.