![]()

Panic Time?

By Paul Lamont

Feb. 29, 2008

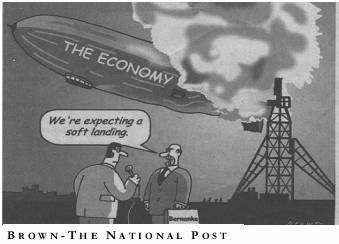

As Charles Kindleberger asks in the investment classic Manias, Panics and Crashes; “the essence of financial distress is loss of confidence. What comes next - slow recovery of belief in the future as various aspects of the economy are corrected, or collapse of prices, panic, runs on banks, a rush to get out of illiquid assets and into money?”

Our timeline of financial distress is below:

“Although the TAF and other

liquidity-related actions appear to have had some positive effects, such

measures alone cannot fully address fundamental concerns about credit quality

and valuation, nor do these actions relax the balance sheet constraints on

financial institutions. Hence, they

alone cannot eliminate the financial restraints affecting the broader economy.

- Ben Bernanke, Jan. 17, 2008

From Foreclosures To Bank Failures

The FDIC is going on a hiring spree in anticipation of “an increase in failed financial institutions as the nation's housing and credit markets continue to worsen.” Jim Marino of the FDIC's Division of Resolutions and Receiverships states “the notion that a bank is too big to fail shouldn't be out there.” As we explained last month, the U.S. banking system is borrowing their entire reserves, currently -$17B, from the Federal Reserve. TheStreet.com also reports that “non-current loans exceeded reserves for the first time since 1993.” On Feb 28th, Ben Bernanke said there probably will be bank failures as the housing slump takes its toll. According to the FDIC Quarterly Banking Report:

“Total noncurrent loans -- loans 90 days or more past due or in nonaccrual status -- rose by $26.9 billion (32.5 percent) in the last three months of 2007. This is the largest percentage increase in a single quarter in the 24 years for which noncurrent loan data are available. Eight institutions accounted for half of the total increase in noncurrent loans in the fourth quarter, but noncurrent loans were up at half of all insured institutions. The percentage of loans that were noncurrent at year-end was 1.39 percent, the highest level since the third quarter of 2002.”

We called the FDIC to inquire as to the eight institutions that accounted for half of the total increase and were told this information is not available to the public.

After a bubble, the institutions that have financed speculators fail. Real estate bubbles are particularly devastating due to the large amount of financing required.

The Real Government Role

As a general rule, government policy/central planning produces the opposite effect intended. There are many examples, one of the most striking is the Farm Bill, according to Time, and “the top 10% of subsidized farmers collect nearly three-quarters of the subsidies, for an average of almost $35,000 per year. The bottom 80% average just $700. That's worth repeating: most farmers, especially the small farmers whose steadfast family values and precarious family finances are invoked to justify the programs, get little or nothing.”

Banking is no different. The Federal Reserve serves as the ‘lender of last resort’ to the banking system. But in a crisis, instead of supporting banks they charge them a fee. How? Instead of earning interest from reserve deposits at the Fed, banks borrowing reserves are forced to pay interest. Currently the Fed is earning interest on $60B that is being lent to the banking system.

A banker is a fellow who lends you his umbrella when the sun is shining, but wants it back the minute it begins to rain. – Mark Twain

FDIC insurance can also impair our banking system. As the FDIC admits:

“when

higher assessment premiums are required under the current policy, they are

likely to be charged when many banks are least able to afford

them…High-risk banks then will be subjected to higher costs when they can

least afford it in terms of both their low profitability and their disadvantage

compared with competitors designated as better risks.”

So, the

Fed and the FDIC actually tax the banking system during a crisis. Our bearish

position is reinforced knowing so many central planning entities are hard at

work.

Bank Losses Wipe Out Consumer Credit

As we mentioned last month, the credit card was one of the last means of credit expansion. But the combination of consumers struggling to pay and the bank’s need for cash is becoming too much. Some banks are canceling cardholders with good credit (or at least hiking their rates) because they aren’t providing lenders with enough fees. Home equity lines are also being cancelled. In general, the cost of credit is getting more expensive. How can a few bad loans destroy the whole system? During the credit boom, loans were packaged together and sold to investors. Investors who are fearful of more losses have boycotted the whole lot. These loan bundles are now facing “unprecedented decline in loan values” and are below the threshold where they will be forced to liquidate according to Bloomberg. This means more losses for financial institutions. As The Bloomberg article concludes:

”’We've got to stop being so afraid,’ New York University's Smith said, invoking the words of U.S. President Franklin D. Roosevelt at his 1933 inaugural address during the Great Depression. ‘When Roosevelt said, `We have nothing to fear but fear itself,' he said it in the context of the banking crisis.’”

Just as confidence spread to culminate into a ‘financial nirvana’ last spring, so fear will spread until the bear market finally ends in panic.

Margin Call

1929

2008

Meet Trent Charlton. He is looking for someone to take over his BMW payment “because he and his wife could not keep up with monthly expenses after American Express reduced the limits on three credit cards.” He has also taken a loan out of his 401k. Trent is faced with a margin call just like the 1929 leveraged stock player pictured above. The “crash” that everyone expects has already occurred. As the New York Times reports, 10.3% of Americans are underwater on their mortgage. As Theresa Perry in the AP article states: "They're not taking money out (of 401ks) to purchase homes anymore. They're taking money out to keep the home they already have.”

To Look Forward Look To The Past

From “The Social History of an American Depression” by Samuel Rezneck;

“The year 1835 was once characterized as the most prosperous the United States had ever known. To Harriet Martineau it seemed ‘as if the commercial credit of New York could stand any shock short of an earthquake’, since it had recovered so rapidly from the losses of the Great Fire in that year. Within two years, however, not only New York but the whole country was convulsed by a shock as devastating as any earthquake could have been. Its depressing effects were felt for several years, and even 1843 was described as ‘one of the gloomiest years in our industrial history’.”

What had happened? “The collapse of business and banking, early in 1837 was, however, only the beginning of a long and severe process of purgation. The purging extended beyond the complicated and congested mass of credits and debits which was the major proof of preceding prosperity. Every class in the community was affected, and economic interests were deeply stirred.” Then as now, “The propertied classes felt the immediate pinch of the general depreciation of values, and were especially articulate in voicing their grievances.”

Prepare Your Spring Garden

As we mentioned in September, “…we don’t know what ‘reason’ will be attributed to agricultural price increases. But we expect food prices (and cotton!) to dramatically rise in 2008.” Corn, wheat, soybeans and sugar have wasted no time in rising as shown in the Powershares DB Agriculture Fund chart below.

While there are fundamental reasons for the rise in food prices, smart money has also entered the sector. As Jim Rogers recently said, “If you're in agriculture, you don't know that there is a recession, you don't care.”

The First Bankers

The Old Testament mandates that personal debts are to be forgiven every seven years. Determined by the Jewish lunar/solar religious calendar, the seventh year is known as Shmita or the Sabbatical Year. Coincidence or not, the Sabbatical Year began on Sept. 13th, 2007. After the end of seven cycles of seven years (roughly every 50 years), Leviticus Chapter 25 describes a kind of ‘mortgage holiday’ called the Jubilee Year. Since the Jubilee Year is no longer observed, we are unsure if the current Sabbatical Year is a completion of the 50 year cycle. But we do find the debt customs of a historical banking culture interesting.

Still Hiding Losses

Bank losses are still being hidden in special purpose entities. Citigroup alone has $320B of these off-balance sheet assets which “may be worth as little as 27 cents on the dollar once they're put back on balance sheets, according to David Hendler, an analyst at New York-based CreditSights.” As we stated in September, these methods to hide losses are very similar to the accounting techniques used by Enron.

They Can Sell Faster Than You

We also mentioned in September that twenty-six Florida cities defaulted on their bonds after the real estate bubble of 1927. Now Vallejo, CA is in trouble. We expect the same thing that happened 80 years ago and recommend investors to avoid municipal bonds. This will also be a complete surprise to bond insurance firms. Banks are already working on a capital infusion for the insurers due to their subprime losses. The insurers’ rating is supporting the value of $2.4T in loans held mostly by banks and as CNBC reports “the banks and the rating agencies are aware that, if it (Ambac) collapses, there will be a huge decline in the stock market.”

The Wall Street Firms will know if the Ambac deal fails long before investors. We commented last April: “As the editor of The Commercial and Financial Chronicle in November of 1929 reported on the Great Crash, ‘the crowd didn’t sell, they got sold out.’ The trading desks of the Wall Street Firms will cash out as the panic develops, the lady in Omaha will be stuck on the phone with a busy signal… To avoid this, investors should be moving now to financially healthy institutions and buying U.S. Treasury Bills.”

At Lamont Trading Advisors, we provide wealth preservation strategies for our clients. For more information, contact us. Our monthly Investment Analysis Report requires a subscription fee of $40 a month. Current subscribers are allowed to freely distribute this report with proper attribution.

***No graph, chart, formula or

other device offered can in and of itself be used to make trading

decisions.

Copyright ©2008 Lamont Trading Advisors, Inc. Paul J. Lamont is President of Lamont Trading Advisors, Inc., a registered investment advisor in the State of Alabama. Persons in states outside of Alabama should be aware that we are relying on de minimis contact rules within their respective home state. For more information about our firm visit www.LTAdvisors.net, or to receive a copy of our disclosure form ADV, please email us at advrequest@ltadvisors.net, or call (256) 850-4161.