![]()

Credit Downturn Force Feeds Wall Street Banks

with Losses

By Paul Lamont

July 13, 2007

During the crash of 1929, investors clung to the hopeful idea that ‘organized support’ would rally the market as values plummeted. We were reminded of this after reading a recent comment at Minyanville: “It's almost as if there was a memo circulated last year instructing everyone commenting on subprime mortgages or real estate to use the phrase ‘well contained.’ Or, worse, we truly are governed by our most basic limbic system functions and herding instincts.” The idea that February’s subprime crash was ‘well-contained’ is proving to be false. Now that the credit market has peaked, February’s event was merely the most speculative (and weakest) aspects of the credit market collapsing first. To understand how the credit market losses are spreading let’s look at Bear Stearns’ two collapsed hedge funds. As far back as April we have warned:

“Current ‘thinking’ is that financial institutions have passed on much of the mortgage risk to hedge funds. However when hedge funds fail, ‘prime brokers’ historically have been forced to accept the hedge fund’s losing positions. Illiquid arrangements (for instance credit derivatives) will then be the responsibility of the prime brokers.”

This is precisely what happened as Bear Stearns was forced to bail out one of its funds with $1.6 Billion. The other fund was too highly leveraged and failed. The collapse of the funds also revealed false CDO (collateralized debt obligations or pools of mortgages) valuations used by the entire industry. According to the Telegraph, “When creditors led by Merrill Lynch forced a fire-sale of assets, they inadvertently revealed that up to $2 trillion of debt linked to the crumbling US sub-prime and ‘Alt A’ property market was falsely priced on books….The banks halted the sale before ‘price discovery’ set off a wider chain-reaction.”

Nobody Move!

Charles Dumas, the Lombard Street Research's global strategist, continues “we don't know what the value of this debt is because the investment banks shut down the market in a cover-up so that nobody would know. There is $750bn of dubious paper out there in the form of CDO’s held by banks that have a total capitalization of $850bn." According to Joshua Rosner, managing director at Graham Fisher & Co., “You'll see massive losses from banks, insurance companies and pension managers…The longer they wait, the worse it's going to be.” How bad? The Telegraph reports “even A-grade tranches of these CDO mortgage debt securities were worth just 85pc of face value, and the B-grades nearer zilch.” Zilch? “...investors in the Bear Stearns Enhanced Leveraged Fund are getting offers of just 5 cents on the dollar for their stakes.” Credit Suisse estimates current CDO losses at $52 billion. Deutsche Bank says $90 Billion. But as long as the holders of the securities do not have to sell or the ratings of the CDO’s do not change, they can assume the value never changed. This is the ‘voodoo’ of mark-to-model accounting. We have previously discussed this in our investment flash in May in which a subscriber, a hedge fund manager, predicted: “Once these CDO's start getting downgraded or hedge funds that own this paper get redemptions and are forced to sell, then things will start to get ugly.”

Credit Downturn Moves Uptown

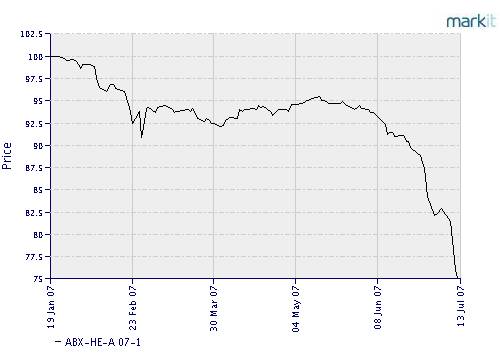

While the focus has been on subprime woes, all mortgage loans are falling in value. In fact according to the ABX index, all credit types peaked in January. The Markit ABX ‘A’ loan derivative index chart is below. It’s down 25%.

‘AA’ loans are also making new lows. The Markit ABX ‘AA’ derivative index chart is below. The index is down 7%. Clearly the credit crunch is now moving into the higher credit ratings.

Wall Street Firms and banks will

have no choice but to accept the losses from mortgages.

There Goes the Neighborhood

In Bloomberg’s article Bear Stearns Meets Possums in Georgia as Foreclosures Increase, homes are increasingly being seized in foreclosure by the Wall Street Firms. “The dilemma facing banks is whether to pay maintenance costs or dump the properties at fire-sale prices,” said Keith Gumbinger, vice president at HSH Associates, a mortgage research firm. Elisa Marks, a Bear Stearns spokeswoman states “the firm sold the Lilac Lane house on June 28 for $84,000… That's about half the price paid two years ago.” Keith Shaughnessy, president of Foundation Mortgage Corp., states “it will have a decimating effect on the mortgage-backed securities market when lenders start facing the music and letting property go at whatever price people will pay.” So not only are the securities (mortgage backed securities/CDO's) falling in value, so is the underlying collateral.

A Bridge Too Far

According to Bloomberg.com, companies are canceling or postponing bond sales “amid concern that losses from bonds backed by U.S. subprime mortgages will spread to other markets.” According to Dow Jones Financial News, “seven out of 10 of the biggest leveraged buyouts have yet to be financed in debt markets.” Private-equity firms need to sell $300 billion of bonds and loans in the later half of the year to finance LBO's, according to Bear Stearns. According to the Telegraph “just $3bn of the $20bn junk bonds planned for issue for the week (Ed Note: two weeks ago) were actually sold.” So where are the bonds that Wall Street promised to sell for the Private-equity firms? Since the market won’t take them, Wall Street banks now have the junk bonds on their balance sheet.

Why is it a problem? Why can’t the banks just absorb these losses?

One Big Margin Call

The pendulum is swinging from easy

to tight money; the deleveraging process is just beginning. Homeowners are receiving

a ‘margin call’ from their bankers in the form of adjustable rate mortgages. Bankers

are also calling hedge funds

to put up more collateral for the CDO’s. But both homeowner and hedge fund

managers are so leveraged that they have no cash for more collateral. Some have

already started to default. Foreclosures have increased. Funds that have been

forced to close from investor redemptions or losses include: Dillion Read, Bear

Stearns, United Capital, Galena Street. Much like other credit panics

throughout history, major investment firms will eventually receive margin calls

from their own investors/depositors because they will be overwhelmed with

losses. For a preview of what’s to come, Banca

Italease’s shares have fallen over

50% since mid-May. The bank was forced to accept roughly $400 million in

derivative bets for one of its clients. Because of the illiquidity of that

market, the losses quickly ballooned to $829 million. How does this affect you? James Carrick, at Legal & General,

said “we are entering ‘historically

dangerous territory’ for the markets; the sudden tightness in bonds was

similar to conditions in autumn 1987, a month before the crash, and again just

before the 1991 recession and the dotcom bust.” When the deleveraging is in

full force, homeowners, investors, hedge fund managers, and Wall Street bankers

will be forced to sell more liquid assets to raise cash for their creditors.

Over the last few months we have used historical examples to warn folks:

In January: “In a credit crunch, optimism turns to fear, risk is re-priced, and the rush to liquidate assets begins. Prices fall and cash is the only haven of value.”

In October: “The down wave that started in April 1930 corresponded with three banking crises and a fall of 85% in the DJIA. It is unfortunate that our banking system has again been weakened, this time by unscrupulous mortgage lenders in the recent housing boom. We believe that we are apt to repeat history’s mistakes because ‘emotion to participate’ (greed) overrides rational thinking.”

In February: “Leverage begins to work in reverse. Investors sell, as their debts now exceed their holdings. Interest rates fall to zero, as the remaining liquidity rushes to safety….The major credit bubbles of the past: 1830’s, 1870’s, 1920’s; all occurred during a period of falling interest rates. Depressions of the 1840’s, 1880’s, and 1930’s followed these credit manias.”

In May: “Murray Rothbard in A History of Money and Banking in the United States described the (Panic of 1837’s) impact on financial institutions: ‘unsound banks were finally eliminated; unsound investments generated in the boom were liquidated. The number of banks fell during these years by 23 percent’….To reiterate: In a crisis, a financial institution’s capital cannot be separated from a hedge fund arm, proprietary trading desk or prime brokerage unit.”

In June: “At the end of every credit boom, there has always been a realization point that the debts (yes, even mortgages) accumulated during the boom have become unsustainable. Interest rates (the cost of debt), then rise to reflect the increase in default risk…. ‘Money’ is therefore hoarded, by either the public or the banks themselves (if they are concerned about an increase in redemptions).”

Time to Prepare

The Bank of International Settlements is now too warning of a major deleveraging: “…years of loose monetary policy has fuelled a dangerous credit bubble, leaving the global economy more vulnerable to another 1930s-style slump than generally understood.”

We have been advising over the last 8 months to sell assets. For most real estate investors it is too late. Much like the summer of 1929, equity investors are now being presented with an ideal opportunity to exit the stock market. It is always better to cash out with profits than to be left waiting for a buyer while the losses mount. If you are fortunate to be liquid, it is equally important to hold cash at secure financial institutions.

For more about our investment management services, visit our website. Our monthly Investment Analysis Report requires a subscription fee of $40 a month. Current subscribers are allowed to freely distribute this report with proper attribution.

Copyright ©2007 Lamont Trading Advisors, Inc. Paul J.

Lamont is President of Lamont Trading Advisors, Inc., a registered investment

advisor in the State of Alabama. Persons in states outside of Alabama should be

aware that we are relying on de minimis contact rules within their respective

home state. For more information about our firm, or to receive a copy of our

disclosure form ADV, please email us at advrequest@ltadvisors.net, or call

(256) 850-4161.